- Medical Student Loan Forgiveness

- New Federal Loan Forgiveness Program

- download free, software Medical Loan Forgiveness Programs Free

- download free, software Medical Loan Forgiveness Programs

The National Health Service Corps Students to Service Loan Repayment Program offers up to $120,000 in tax-free student loan repayment (up to $30,000 a year for four years) for fourth-year medical.

- Jan 04, 2019 A good place to check the medical loan repayment and forgiveness programs available in your area is through the AAMC database. Here are just two examples of the many state-specific programs: The Arizona Loan Repayment Program offers up to $65,000 in exchange for a two-year commitment from physicians.

- The Loan Repayment Program for Health Disparities Research (LRP-HDR) - This program supports health professionals involved in clinical behavior, social science, or health service research addressing health disparities. It is stated that at least 50 percent of the recipients of this program must be from a health disparity population.

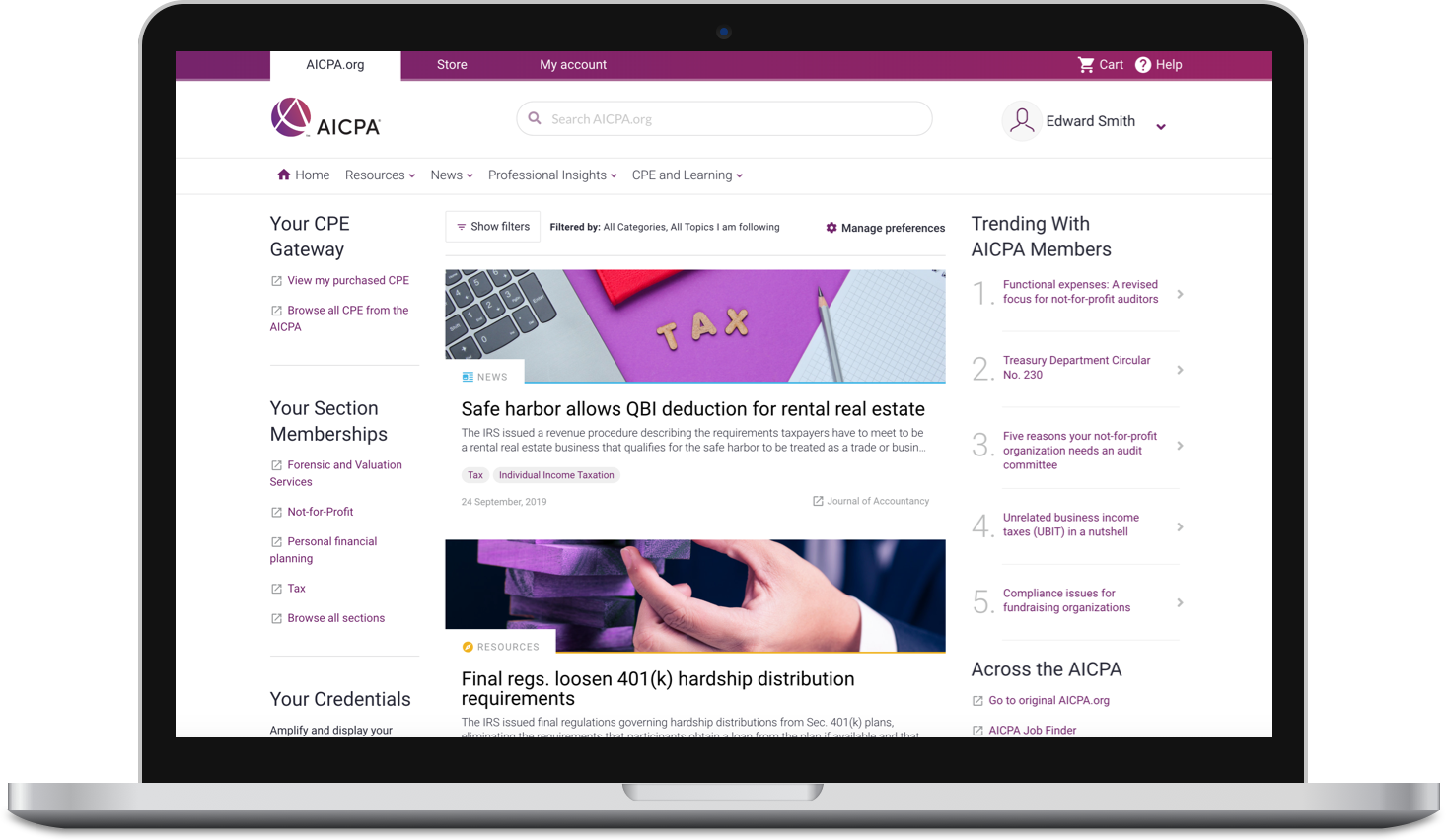

A new, free tool developed by the AICPA and fintech lender Biz2Credit is designed to help borrowers and their CPA advisers complete the forgiveness application for Paycheck Protection Program (PPP) loans.

Available at PPPForgivenessTool.com, the dynamic platform automates the forgiveness process for small business owners who received funds from the PPP. The tool incorporates the PPP forgiveness calculator developed by the AICPA and is available to any business approved for a PPP loan, regardless of the lender it worked with to receive funding.

Borrowers or their CPA advisers can use the tool to fill out the forgiveness application. The tool will produce all government-required forms automatically. The PPP applicants will be able to electronically sign the SBA Form 3508, PPP Loan Forgiveness Calculation Form, or Form 3508EZ, and the required source documents will be saved into a downloadable file that can be provided to PPP lenders.

Medical Student Loan Forgiveness

The AICPA estimates that the tool will save hours of manual work for any applicant going through the PPP loan forgiveness process. Final Treasury and U.S. Small Business Administration (SBA) FAQs on PPP forgiveness are expected to be released soon, and the PPP loan forgiveness tool will be updated to reflect any new changes. Based on this, the AICPA recommends that borrowers and CPA firms wait for the final guidance before generating the final signed Form 3508.

CPA.com, the AICPA’s business and technology arm, helped develop the tool. The tool’s platform was developed by fintech lender Biz2Credit. The objective is to drive a simple, effective forgiveness process, said Erik Asgeirsson, president and CEO of CPA.com.

“Our broader goal with this tool is to also help drive a common approach to this process with the payroll and lender communities,” Asgeirsson said in a news release.

New Federal Loan Forgiveness Program

The open architecture of the platform enables easy integration into the forgiveness tool. Payroll providers and other companies that hold small business data are able to automate the import of source data they hold, such as payroll reports, increasing the speed with which businesses can complete their forgiveness applications.

More information on the tool is available at PPPForgivenessTool.com. In addition, videos are available providing a brief overview of the tool for borrowers and how CPA firms can use the platform.

The PPP in brief

Congress created the PPP as part of the $2 trillion Coronavirus Aid, Relief, and Economic Security (CARES) Act, P.L. 116-136. The legislation authorized Treasury to use the SBA’s 7(a) small business lending program to fund forgivable loans of up to $10 million per borrower that qualifying businesses could spend to cover payroll, mortgage interest, rent, and utilities.

The loans are available to small businesses that were in operation on Feb. 15 with 500 or fewer employees, including not-for-profits, veterans’ organizations, Tribal concerns, self-employed individuals, sole proprietorships, and independent contractors. Businesses with more than 500 employees in certain industries also can apply for loans.

Congress designed the loans to support organizations facing economic hardships created by the coronavirus pandemic and assist them in continuing to pay employee salaries. PPP loan recipients can have their loans forgiven in full if the funds were used for eligible expenses and other criteria are met. The amount of the loan forgiveness may be reduced based on the percentage of eligible costs attributed to nonpayroll costs, any decrease in employee headcount, and decreases in salaries or wages per employee.

The AICPA’s Paycheck Protection Program Resources page houses resources and tools produced by the AICPA to help address the economic impact of the coronavirus.

download free, software Medical Loan Forgiveness Programs Free

For more news and reporting on the coronavirus and how CPAs can handle challenges related to the pandemic, visit the JofA’s coronavirus resources page or subscribe to our email alerts for breaking PPP news.

download free, software Medical Loan Forgiveness Programs

— Ken Tysiac (Kenneth.Tysiac@aicpa-cima.com) is the JofA’s editorial director.